Public engagement in the arts emerging from the COVID-19 pandemic: Canadian analysis and regional differences

(Originally published in December 2021)

With the goal of enhancing the arts sector’s understanding of engagement behaviours and trends, this SIA Brief analyzes several Canadian information sources related to public engagement and spending in the arts.

This information could help arts organizations enhance their communications and marketing as the country emerges from the pandemic and as arts sector renewal and regeneration take place. Organizations could communicate the fact that people who have attended indoor arts activities have found them to be very safe. In addition, organizations could implement and emphasize risk mitigation measures that research has shown to be important, including controlled access with limited lineups, proof of vaccination, masking, limiting the number of attendees, and physical distancing. Another measure suggested by the research is easy cancellations if pandemic conditions or attendees’ situations change.

Like everyone else, we do not have a crystal ball to foresee how the arts sector will emerge from the pandemic and, specifically, how Canadians will perceive the risks and rewards of arts participation. There are negative and positive signs, which we outline below.

Key findings

Pessimistic

· 56% of pre-pandemic attendees expected to wait before returning to indoor arts or cultural performances, and 49% expected to wait before returning to art galleries or museums.

· Throughout the pandemic, many pre-pandemic attendees have remained unsure about when they would return.

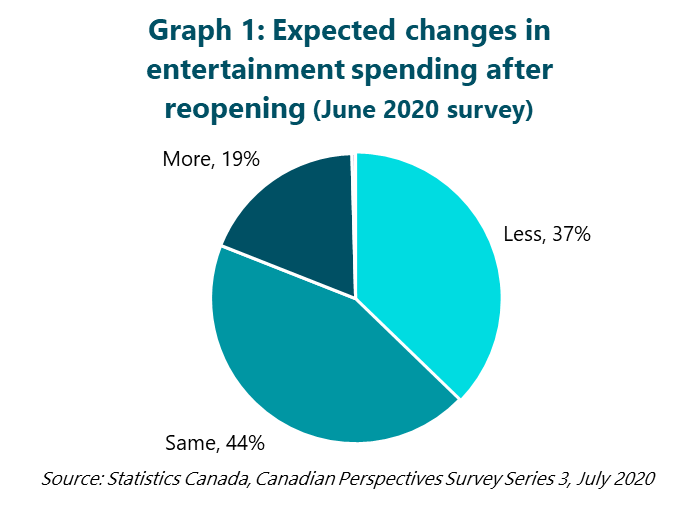

· Many more Canadians planned to reduce (37%) than increase (19%) their spending on entertainment after the pandemic, compared with their pre-pandemic levels.

· Some pre-pandemic attendees have seen their income decrease, while others have changed their spending habits or taken on new hobbies.

Optimistic

· Spending on culture goods and services has increased consistently since a severe pandemic-induced decrease in the second quarter of 2020.

· Surveys show that many Canadians have missed and are eager to return to arts activities.

· Ontarians who recently attended indoor arts activities have felt very comfortable doing so. On a scale from 1 to 5, about 90% of attendees rated their comfort level as either 4 or 5.

Regional differences

· Public engagement intentions vary by region. For example, residents of Quebec and the Atlantic provinces are most likely to have already visited an art gallery or museum and least likely to wait before doing so. Residents of Ontario and the Prairies are least likely to have already visited and most likely to wait before doing so. Residents of British Columbia are between these two extremes.

Unanswered questions

· With about one-half of pre-pandemic arts attendees waiting before attending arts activities, are there enough willing and ready attendees to fuel a full renewal of the arts?

· Have many Canadians permanently diverted their time and money away from activities that were not available during much of the pandemic, such as out-of-home arts activities?

· Can arts organizations, many of which are already in a precarious situation, afford to offer easy cancellations and refunds?

· Will arts sector risk taking be inhibited if the overriding goal is to generate predictable revenues?

· How lasting is the switch to online participation? Can this provide a solid business model for the arts?

· The pandemic has been particularly difficult for many Indigenous, racialized, D/deaf, and disabled Canadians. If arts engagement is negatively affected, what might this mean for artists and arts organizations that serve these communities?

· Are there differing situations between rural areas and large urban centres? Between smaller and larger organizations?

· In a crisis such as the pandemic, can the arts be better integrated into government responses such as wellbeing and mental health initiatives?

· Has the pandemic had an influence on the accessibility of some arts activities, thanks to digital engagement, the prevalence of outdoor performances, (generally) lower ticket prices for digital works, and new outreach strategies?

The case for pessimism about public engagement in the arts

Survey data show that many Canadians are hesitant to return to arts activities. According to an August survey, over one-half (56%) of pre-pandemic attendees expected to wait before returning to indoor arts or cultural performances, and 49% expected to wait before returning to art galleries or museums. A relatively large proportion of respondents were unsure when they would return (31% of both indoor performance attendees and museum or gallery visitors).[1] Over time, there has been little change in the proportion of pre-pandemic performance attendees indicating that they were unsure when they would return (35% in May 2020 and 31% in August 2021). The proportion of pre-pandemic gallery or museum visitors who were unsure about attending did decrease, from 42% in May 2020 to 31% in August 2021.

A September survey of pre-pandemic arts attendees in Ontario found that 46% are still “waiting for low infection rates” before returning to in-person arts and cultural events.[2]

The pessimistic view seems to be borne out by the recent experiences of some Quebec venues. After venues were allowed to move to full capacity in mid-October, a newspaper article questioned some arts sector leaders about their attendance situations.[3] Many reported disappointing attendance levels, with the notable exception of concerts at Montreal’s arena, the Bell Centre.

As noted in an Alberta report, “comfort levels, risk tolerance, and consumer mindset continue to shift with conditions”. Based on a survey conducted in June 2021 – at a time of strongly decreasing case numbers in Alberta – the report concluded that “that there will be less of a return to ‘normal’ [than] a new way of doing things moving forward”. Arguing against the notion of “pent-up demand” for activities missed during the pandemic, the report indicates that many have diverted their spending from unavailable activities “to other things (whether that be new hobbies or things like household projects)”. Others have seen their income decrease during the pandemic. “In short, spending habits are in flux and at this point, it is difficult to predict where Albertans will direct their money in the short term.”[4]

These findings are reinforced by those from an early-pandemic survey of Canadians (see Graph 1). In June 2020, more Canadians indicated that they planned to reduce their spending on entertainment “after businesses and organizations start to reopen” (37%) than said that they would increase their entertainment spending (19%). The remaining 44% expected to spend the same amount as before the pandemic. The ratio of people expecting to spend more on entertainment to those who expect to spend less (0.5) ranks 13th out of 14 spending items included in the survey.[5]

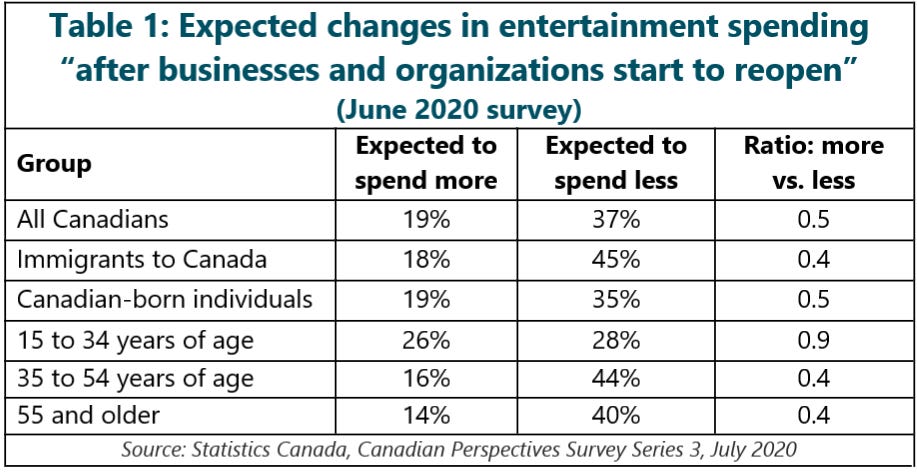

An analysis of the demographic variables available in this survey (Table 1) shows that there were differences in the entertainment spending expectations of different groups of Canadians. Immigrants were less optimistic than non-immigrants. Younger Canadians were relatively optimistic about their expected spending on entertainment.

The case for optimism about public engagement in the arts

There are some positive statistics related to arts engagement. Broad statistics show that the total value of all goods and services sold in the culture sector have increased in every quarter since the severe pandemic-induced decrease in the second quarter of 2020.[6] Some organizations in the arts, entertainment, and recreation have fared relatively well during the pandemic, counter to the predominant trend. In fact, one in every five organizations or businesses (21%) had stable or increasing revenues between 2019 and 2020.[7]

A September survey of Ontario arts attendees found very strong feelings of safety among those who had recently attended an in-person event. On a scale from 1 to 5, about 90% of indoor attendees rated their comfort level as either 4 or 5. For indoor performing arts events, 61% rated their comfort level as 5, and another 30% rated it as 4. For museums or galleries, 62% rated their comfort level as 5, and another 26% rated it as 4. These ratings are almost as high as those for outdoor performing arts events (65% rating as 5 and 28% as 4).[8]

Many Canadians have been eager to return to arts activities. As of August 2021, about one-third of pre-pandemic arts goers had already visited an art gallery or museum (32%) or attended an outdoor performance (36%). For indoor performances, only 19% had already attended. Many other Canadians expected to return “immediately after businesses, government, and cultural organizations are reopened and following public health guidelines”, including 19% of pre-pandemic art gallery and museum visitors, 24% of pre-pandemic attendees at outdoor performances, and 25% of pre-pandemic attendees at indoor performances.[9]

Survey research in Quebec asked pre-pandemic arts attendees how much they miss certain arts and entertainment activities.[10] To our knowledge, no Canada-wide studies have specifically addressed this topic. In addition to the fact that many pre-pandemic arts attendees miss arts activities “a lot”, there were significant increases in the proportion of attendees who miss each activity between an April 2020 survey and the most recent iteration in February 2021 (see Table 2).

Regarding online alternatives, the Quebec survey found that 76% of consumers of any type of entertainment (i.e., arts, sports, restaurants, or bars) strongly agreed that online events “will never replace attending in person”.

Regional differences in public engagement in the arts

There have been significant differences in the track of the pandemic and in public health restrictions in different regions of the country. As such, it is not surprising that there are some regional differences in public engagement in the arts.

Graph 2 provides data on residents in five Canadian regions who had already visited an art gallery or museum (as of August 2021) and those who expected to wait at least one month before visiting. Residents of Quebec and the Atlantic provinces are most likely to have already visited an art gallery or museum and least likely to wait before doing so. Residents of Ontario and the Prairies are least likely to have already visited and most likely to wait before doing so. Residents of British Columbia are between these two extremes.

Regarding indoor arts performances, Graph 3 shows that, as of August, Quebec residents are most likely to have already visited an indoor performance and least likely to wait at least one month before doing so. In every other region, more than one-half of respondents expected to wait at least one month before attending an indoor performance, and relatively few had already attended. The most extreme situations are in Ontario and British Columbia, where many times more respondents expected to wait than those who had already attended.

These findings mirror the regional data from the June 2020 survey of expected spending on entertainment. At that time, Quebec respondents were the most optimistic about their future entertainment spending, as shown in Table 3. In all other regions, more than twice as many respondents expected to spend less on entertainment than those who expected to spend more.

What can artists and arts organizations do?

Research findings do not provide a magic formula for ensuring that people feel safe, but they do provide some tips as to what artists and organizations can do and communicate to attendees and potential attendees.

An August survey asked respondents about “precautions that need to occur to make you comfortable” returning to arts activities.[11] At that time, 65% of all Canadians and 75% of those 12 and older had been fully vaccinated.

· 44% of pre-pandemic art gallery or museum visitors who were unsure when they would return indicated that a “majority of people getting vaccinated/vaccine proof” would be important. Beyond this measure, which is in now in place in many Canadian jurisdictions, there was no consensus about measures to make the unsure feel safe: 28% said “masks”, and 21% said “physical distancing”.

· The results were similar for pre-pandemic indoor performance attendees. 53% of those who were unsure when they would return said that a “majority of people getting vaccinated/vaccine proof” would be important. No other safety measure was mentioned by more than one-quarter of this group of respondents: just 24% said “masks”; 19% said “physical distancing / spacing between seats”; and the same percentage (19%) said “fewer cases” of COVID-19.

An Ontario survey conducted in September asked more specifically about pre-pandemic attendees’ “minimum level of health safety measures [required] in order to attend an indoor cultural event this week”. One-half of respondents (51%) said that their minimum requirement is all three of the following: masking, proof of vaccination, and physical distancing. Another 27% of respondents did not require physical distancing (just masks and proof of vaccination); 5% chose masks alone; and 5% would attend under any circumstances. Notably, 13% of pre-pandemic attendees would not attend no matter what safety measures are in place.[12]

A Quebec survey conducted in February, at a time when mass vaccination was just starting in Quebec and elsewhere in Canada, asked more detailed questions about potential mitigation measures. The question was “How much does each piece of information below influence your intention to buy tickets for a [specific event] you really want to attend?”[13] As of February, only 1% of the population had been vaccinated, and “access for vaccinated guests only” was not a common response for any entertainment activity.

For museums and galleries, 90% of pre-pandemic visitors indicated that “controlled access to avoid queues” would have either a somewhat or very positive influence. Limiting the number of visitors would have a positive influence on 86% of pre-pandemic visitors, and offering tickets that could be cancelled or refunded would have a positive influence on 85% of pre-pandemic visitors. Mandatory masks would have a positive influence on 82% of pre-pandemic visitors.

For indoor performances, 86% of pre-pandemic attendees indicated that tickets that could be cancelled or refunded would have either a somewhat or very positive influence on them. Controlled access to avoid queues would have a positive influence on 83% of pre-pandemic attendees. Two measures would each have a positive influence on 78% of pre-pandemic attendees: ensuring that venues are carefully disinfected and limiting the number of attendees. Mandatory masks would have a positive influence on 72% of pre-pandemic attendees.

Limitations

The research covered in this report did not break down data for Indigenous, racialized, D/deaf, or disabled Canadians. COVID-19 case rates have been above average in many of these communities, and members of these groups may have different engagement preferences.

The pandemic situation has varied (and continues to do so) over time in different provinces and territories. In such a shifting environment, it is difficult to collect accurate, up-to-date information about engagement preferences and safety considerations.

Data on the three territories were not available in any of the datasets used in this report.

Note

This publication was originally funded through a pilot project with the Azrieli Foundation, the Metcalf Foundation, and the Rozsa Foundation. It is reproduced here for ease-of-access only (and without any paywall).

[1] Business/Arts, National Arts Centre, and Nanos Inc., Culture goers are concerned about the survival of arts and culture organizations, October 2021, http://www.businessandarts.org/resources/arts-response-tracking-study/.

[2] WolfBrown, Audience Outlook Monitor: Findings from Ontario (Research Notes: September 2021), November 2021, https://www.arts.on.ca/research-impact/research-publications/wolfbrown-covid-19-audience-outlook-monitor-ontario?lang=en-ca.

[3] Catherine Lalonde, Les salles de spectacle ne se remplissent pas, Le Devoir, October 14, 2021, https://www.ledevoir.com/culture/640203/arts-vivants-les-salles-de-spectacle-ne-se-remplissent-pas

[4] Stone-Olafson, The New Experience Economy: The Intersection of Arts, Culture, Sports & Recreation in a

Pandemic and Post-Pandemic Environment, Phase 6 Results, July 2021, https://www.stone-olafson.com/insights/experienceeconomy-results

[5] Farhana Khanam and Sharanjit Uppal, Expected changes in spending habits during the recovery period, Statistics Canada, July 22, 2020, https://www150.statcan.gc.ca/n1/pub/45-28-0001/2020001/article/00060-eng.htm.

[6] Not adjusted for inflation. Source: Table 36-10-0452-01: Culture and sport indicators by domain and sub-domain, by province and territory, product perspective, https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3610065201.

[7]. Statistics Canada, Table 33-10-0317-01: Business or organization revenue from 2020 compared with 2019, by business characteristics, https://www150.statcan.gc.ca/t1/tbl1/en/tv.action?pid=3310031701&pickMembers%5B0%5D=3.13.

[8] WolfBrown, Audience Outlook Monitor: Findings from Ontario (Research Notes: September 2021), November 2021, https://www.arts.on.ca/research-impact/research-publications/wolfbrown-covid-19-audience-outlook-monitor-ontario?lang=en-ca.

[9] Business/Arts, National Arts Centre, and Nanos Inc., Culture goers are concerned about the survival of arts and culture organizations, October 2021, http://www.businessandarts.org/resources/arts-response-tracking-study/.

[10] Habo, Entertainment barometer: Quebecers and entertainment in times of COVID-19 (Edition 6), March 2021, https://habo.studio/entertainment-barometer-march-2021/

[11] Business/Arts, National Arts Centre, and Nanos Inc., Culture goers are concerned about the survival of arts and culture organizations, October 2021, http://www.businessandarts.org/resources/arts-response-tracking-study/.

[12] WolfBrown, Audience Outlook Monitor: Findings from Ontario (Research Notes: September 2021), November 2021, https://www.arts.on.ca/research-impact/research-publications/wolfbrown-covid-19-audience-outlook-monitor-ontario?lang=en-ca.

[13] Habo, Entertainment barometer: Quebecers and entertainment in times of COVID-19 (Edition 6), March 2021, https://habo.studio/entertainment-barometer-march-2021/