Trends in Canada’s international trade in the arts, culture, and heritage between 2010 and 2023

Analysis of national and provincial data

Before digging into the trade data, I want to note that this evening I will be sharing tips and resources on mining public datasets, especially from Statistics Canada, for information about the arts, culture, and heritage. The Toronto-based event is hybrid, so online attendance is also possible. 7pm EST. Information and registration at https://civictech.ca/hacknights/526/

Today’s article examines the following questions:

How has Canada’s cultural trade deficit changed since 2010?

How has Canada’s arts trade surplus or deficit changed since 2010?

Which provinces have had cultural trade surpluses? How has each province’s cultural trade surplus or deficit changed since 2010?

The surpluses and deficits are calculated as cultural exports minus cultural imports and have been adjusted for inflation.

This is the third article in a series related to Statistics Canada’s dataset on exports and imports of the arts, culture, and heritage. Previous articles contained analyses of the most recent data for Canada and the provinces. Next week, I will highlight Canada’s trade surplus or deficit with the United States in culture (overall) and the arts, including trends since 2010.

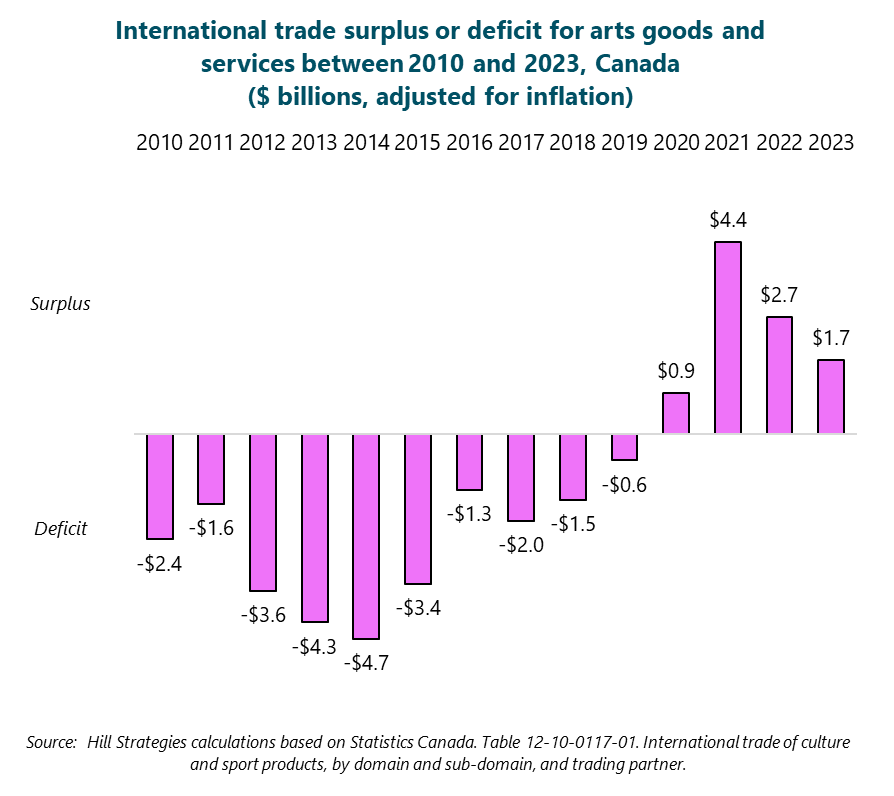

The arts trade deficit has become a surplus

In keeping with my previous analyses, I am combining selected domains and subdomains into an imperfect but reasonable approximation of “the arts”: live performances, visual arts (including crafts and photography), books, film and video, and sound recording.

In 2023, there was an international trade surplus in the arts of $1.7 billion. Today’s first graph shows that Canada had an arts trade deficit between 2010 and 2019. In 2020, imports of arts goods and services decreased significantly, but arts exports did not decrease at all. This resulted in the first arts trade surplus since 2010, a surplus that has continued through 2023.

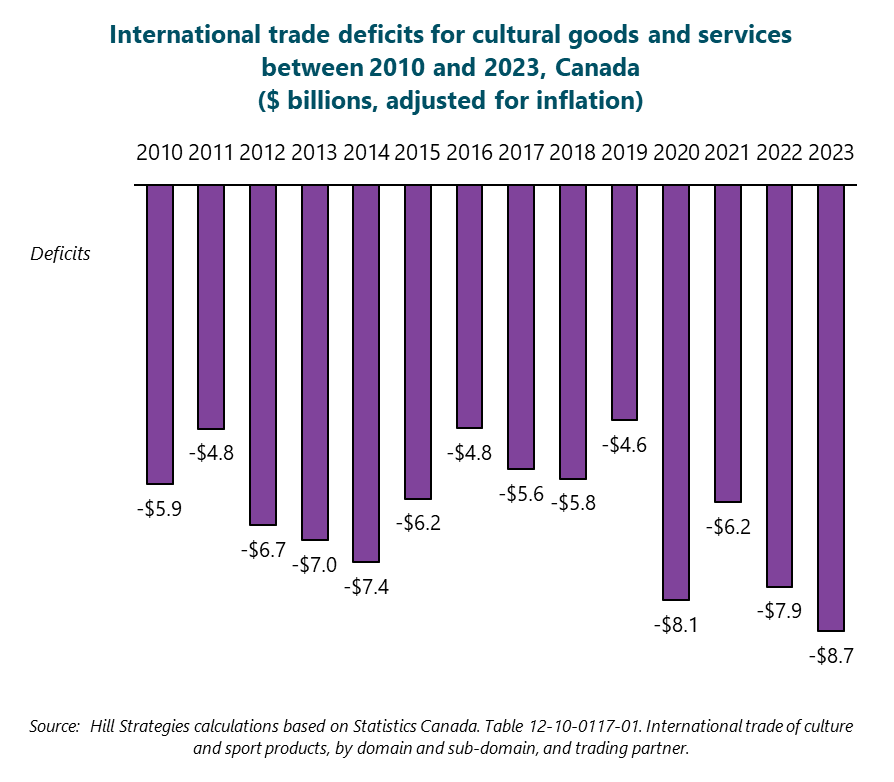

The cultural trade deficit has tended to increase since 2010

In 2023, Canada exported $27.1 billion and imported $35.8 billion of cultural goods and services, resulting in a cultural trade deficit of $8.7 billion (or 32% of the value of the country’s cultural exports). There has been a cultural trade deficit in every year since 2010.

As shown in the following graph, the cultural trade deficit was highest in 2023 and was very high in two other recent years (2022 and 2020). The statistics in the graph have been adjusted for inflation.

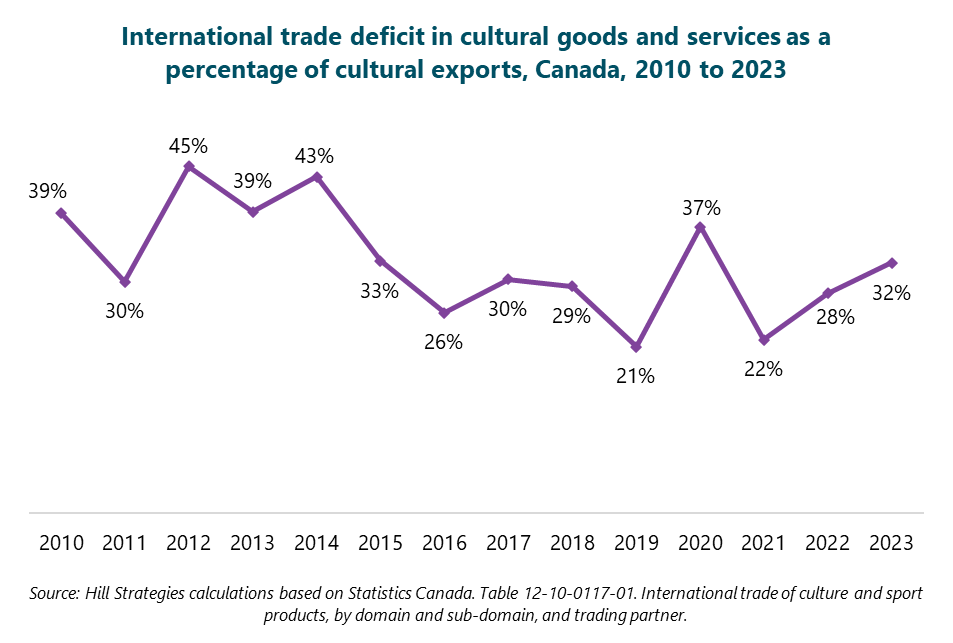

As a percentage of exports, the cultural trade deficit has varied over time

While the cultural trade deficit has tended to increase, the deficit as a percentage of cultural exports has varied considerably but has tended to decrease, as shown in the following graph. The deficit was 39% of the value of cultural exports in 2010 and 32% in 2023.

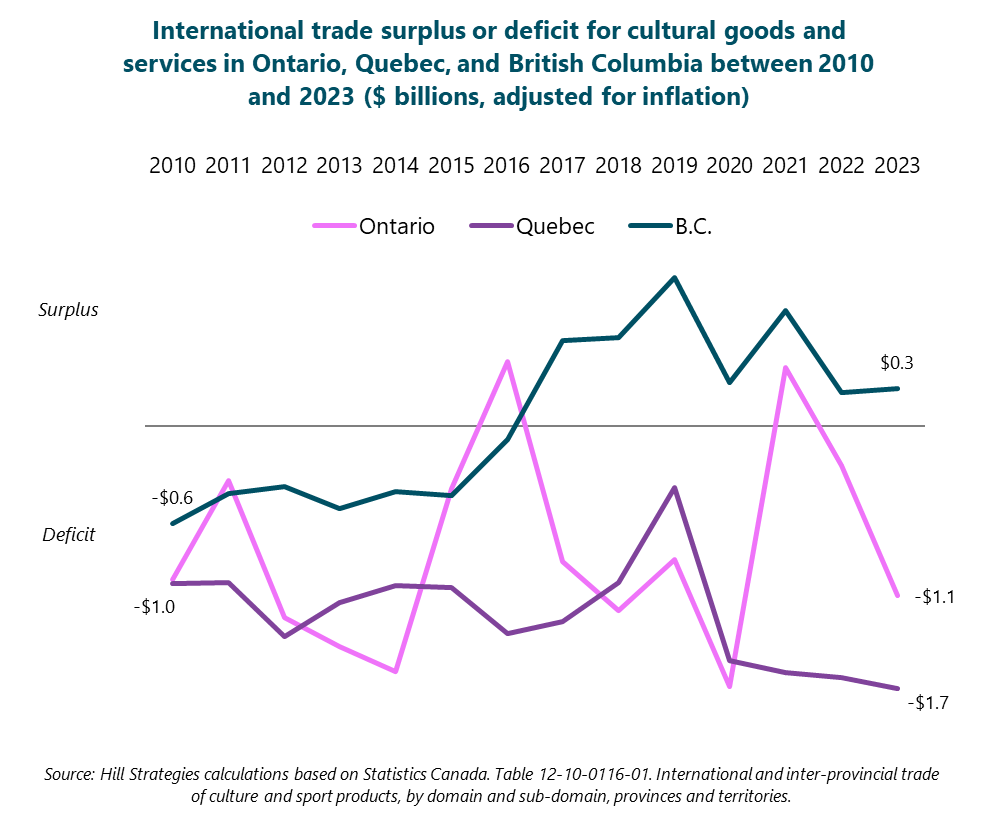

Changes in the cultural trade deficit or surplus in each province

My analysis in last week’s article showed that only British Columbia had an international trade surplus in culture in 2023 ($250 million).

Over the 14 data periods from 2010 to 2023, B.C. has had 7 cultural trade surpluses and 7 deficits. B.C.’s trade deficits from 2010 to 2016 changed to consistent trade surpluses as of 2017.

Only two other provinces have had cultural trade surpluses at any time between 2010 and 2023:

Manitoba had 4 surpluses between 2010 and 2013.

Ontario had surpluses in 2016 and 2021.

The 7 other provinces have had trade deficits in all 14 data periods from 2010 to 2023.

Trends in Ontario, Quebec, and British Columbia

The first provincial graph shows the cultural trade deficits and surpluses over time in the three largest provinces: Ontario, Quebec, and British Columbia. In B.C., the cultural trade deficit of $640 million in 2010 had changed to a surplus of $250 million in 2023. Ontario has had a cultural trade deficit in most years but achieved a surplus in 2016 and 2021. Ontario’s cultural trade deficit was $1.0 billion in 2010 and $1.1 billion in 2023. Quebec’s cultural trade deficit has grown from $1.0 billion in 2010 to $1.7 billion in 2023.

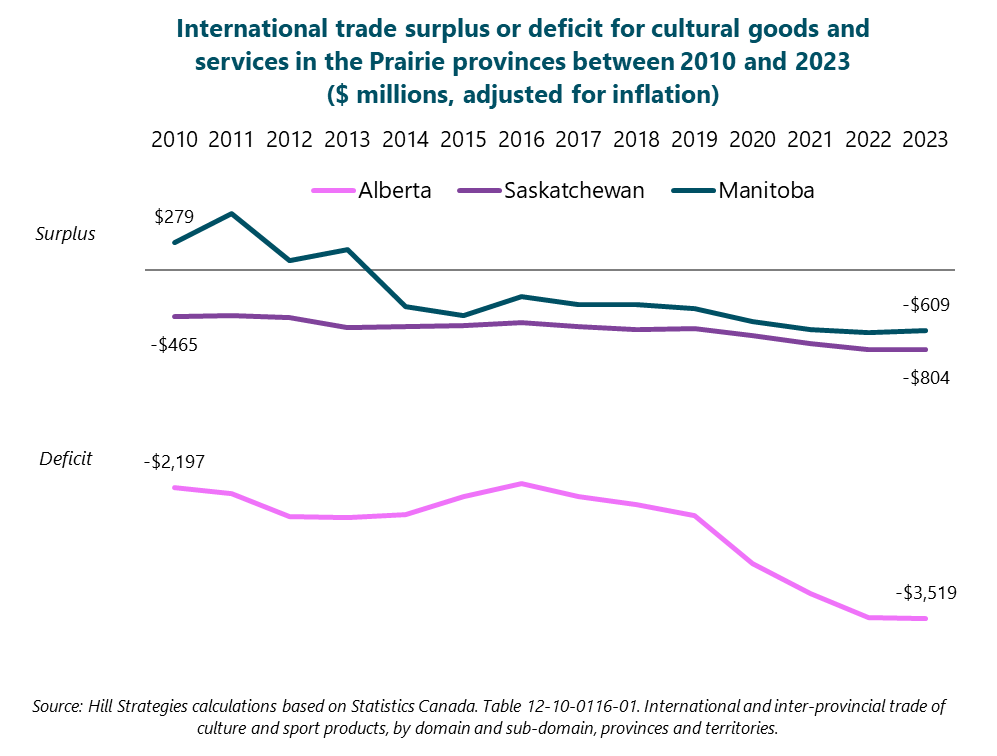

Trends in the Prairie provinces

The second provincial graph shows the cultural trade deficits and surpluses over time in the three Prairie provinces. In Manitoba, the cultural trade surplus of $279 million in 2010 had changed to a $609 million deficit by 2023. The cultural trade deficit in Saskatchewan increased slowly but consistently, from $465 million in 2010 to $804 million in 2023. In Alberta, the cultural trade deficit increased from $2.2 billion in 2010 to $3.5 billion in 2023.

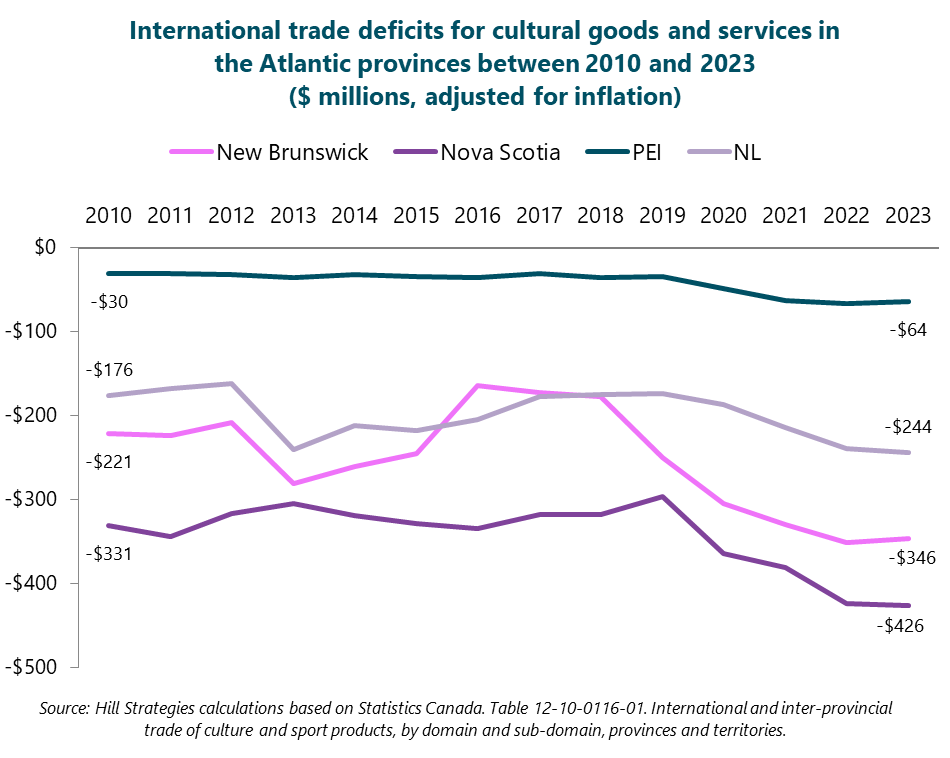

Trends in the Atlantic provinces

The final provincial graph shows that the cultural trade deficits increased between 2010 and 2023 in all four Atlantic provinces:

In Prince Edward Island, the cultural trade deficit increased from $30 million in 2010 to $64 million in 2023.

In Newfoundland and Labrador, the deficit increased from $176 million in 2010 to $244 million in 2023.

In New Brunswick, the deficit increased from $221 million in 2010 to $346 million in 2023.

In Nova Scotia, the deficit increased from $331 million in 2010 to $426 million in 2023.

Data sources and notes

Sources: Statistics Canada. Table 12-10-0117-01. International trade of culture and sport products, by domain and sub-domain, and trading partner, 2023; Table 12-10-0116-01. International and inter-provincial trade of culture and sport products, by domain and sub-domain, provinces and territories, 2023; and Table 18-10-0005-01. Consumer Price Index, annual average, not seasonally adjusted.

Note: Statistics Canada also publishes data on interprovincial trade in cultural goods and services, but the most recent data are only from 2021. Because the data are quite old, I’m not including them here.

The international trade dataset is based on multiple sources, including surveys and administrative filings by cultural businesses, organizations, and individuals. As just one example, here is the main export-related question from the performing arts survey:

During the reporting period [of x to y], did this business receive revenue from clients outside Canada for the sale of products, services, royalties, rights, licensing or franchise fees?

If the respondent answered yes, they were asked follow-up questions regarding revenues from their exports and the percentage breakdowns of exports by country as well as into 1) goods; 2) services; and 3) royalties, rights, licensing and franchise fees.

The series of questions related to imports is identical to the above, except that the questions refer to “payments to suppliers outside Canada” rather than “revenue from clients outside Canada”.