International trade in arts, culture, and heritage in 2023

Drilling into the most recent Canadian data on exports, imports, and surpluses or deficits

Welcome to 2026! Today’s post delves into recently released data on revenues and expenses for the export and import of cultural goods and services in 2023. I examine trade by type of cultural good or service, including an imperfect but reasonable approximation of “the arts”. The data relate to cultural products, not cultural industries.

Recognizing that 2023 trade data are not particularly current in the present environment, I looked into quarterly datasets on international trade. However, as often happens, the categories that are published quarterly (e.g., “personal, cultural, and recreational services”) are very broad and not informative about the situation of the arts, culture, and heritage. I am therefore sticking to an analysis of the 2023 dataset, which was released in late October.

Future articles will examine international trade into and from each province, as well as trends in cultural trade since 2010.

Canada exports $27 billion in arts, culture, and heritage goods and services

Statistics Canada’s summary of the trade dataset highlighted some key statistics:

Canada exported cultural goods and services worth $27.1 billion in 2023.

Canada imported $35.8 billion of cultural products worth in 2023, resulting in a cultural trade deficit of $8.7 billion.

Cultural goods and services represented 2.8% of all exports and 3.7% of all imports in 2022. (Both are increases from 2022, when exports were 2.6% and imports were 3.4%.)

Of nine cultural areas, live performance is “the only domain to remain below pre-pandemic levels, despite a 23.9% increase from 2022”.

Today’s first graph highlights the basic facts about Canada’s cultural trade in 2023.

By my calculation, the cultural trade deficit represents 32% of all cultural exports in 2023 (an increase from 30% in 2022). In other words, Canadians spent 32% more on cultural goods and services from abroad than we exported.

Cultural areas with a trade surplus

Despite the overall trade deficit of $8.7 billion in cultural goods and services, five specific areas registered a trade surplus:

Film and video: $3.9 billion

Crafts: $1.1 billion

Interactive media: $0.9 billion

Architecture: $27 million

Advertising: $15 million

Below the paywall, the article digs into the most recent data on the value of exports, imports, and trade surplus or deficit for each cultural domain, for an approximation of the arts, and for specific types of arts products, including visual arts, performing arts, film and video, books, and more. The American share of cultural trade is also highlighted.

One main cultural trading partner

In 2023, the United States accounted for roughly two-thirds of all cultural exports ($18.1 billion, or 67%) and imports ($22.2 billion, or 62%). Canada had a $4.2 billion trade deficit with the US in 2023.

The value of cultural trade with the US and the American share of trade for each product vary between select arts goods and services:

Crafts: exports of $6.7 billion (92% of all crafts exports), imports of $4.1 billion (65% of all crafts imports), surplus of $2.7 billion (after rounding)

Film and video: exports of $3.8 billion (67% of all film and video exports), imports of $1.1 billion (64% of all film and video imports), surplus of $2.7 billion

Books: exports of $0.8 billion (88% of all books exports), imports of $2.4 billion (78% of all books imports), deficit of $1.6 billion

Live performances: exports of $0.6 billion (56% of all live performance exports), imports of $0.9 billion (55% of all live performance imports), deficit of $0.3 billion

Trade by type of cultural good or service in 2023

Two cultural domains account for nearly three-quarters of the $27.1 billion in cultural exports and over one-half of the $35.8 billion in cultural imports:

Visual and applied arts: exports of $11.3 billion (42% of all cultural exports), imports of $11.5 billion (32% of all cultural imports), deficit of $0.2 billion

Audio-visual and interactive media: exports of $8.3 billion (31%), imports of $7.4 billion (21%), surplus of $0.9 billion

The other domains tracked by Statistics Canada each contribute about $2 billion or less in exports:

Written and published workers: exports of $2.1 billion (8% of all cultural exports), imports of $9.2 billion (26% of all cultural imports), deficit of $7.1 billion

Education and training: exports of $1.3 billion (5%), imports of $0.2 billion (0.5%), surplus of $1.1 billion

Governance, funding, and professional support: exports of $1.2 billion (4%), imports of $0.6 billion (2%), surplus of $0.6 billion

Live performances: exports of $1.0 billion (4%), imports of $1.6 billion (5%), deficit of $0.6 billion

Sound recording: exports of $1.0 billion (4%), imports of $1.1 billion (3%), deficit of $0.2 billion

Heritage and libraries: exports of $0.2 billion (1%), imports of $0.8 billion (2%), deficit of $0.5 billion (after rounding)

Multi domain: exports of $0.7 billion (2%), imports of $3.5 billion (10%), deficit of $2.8 billion

Trade in arts goods and services in 2023

As shown in the following graph, Canada had a trade surplus in (my best approximation of) arts-related goods and services in 2023:

Canadian exports of arts goods and services amounted to $15.9 billion (59% of all cultural exports).

Canadian imports of arts goods and services totalled $14.2 billion (40% of all cultural imports), resulting in an arts trade surplus of $1.7 billion.

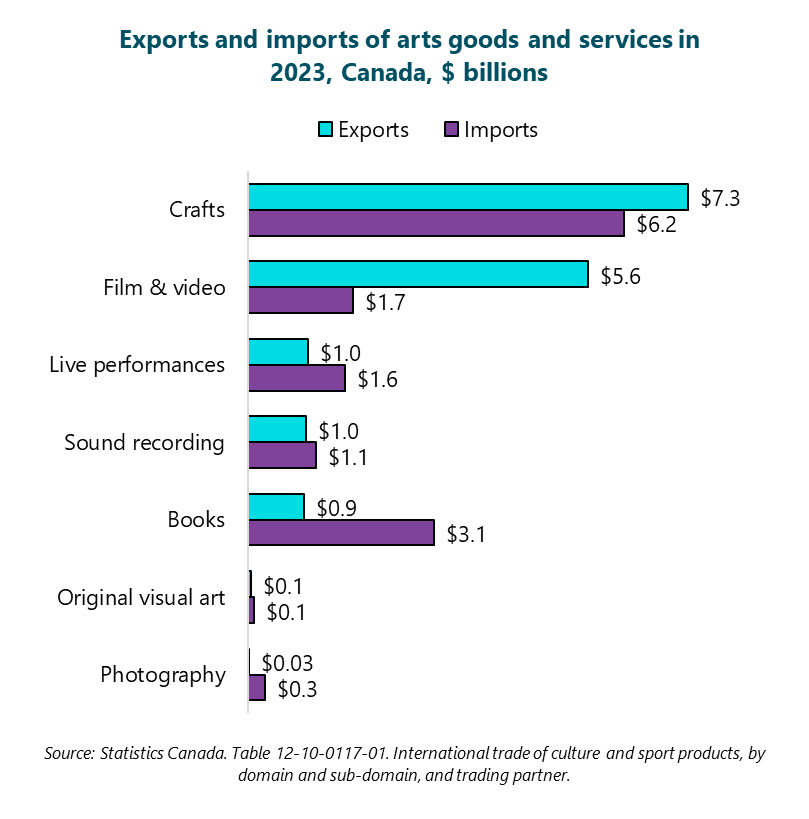

Trade in specific arts goods and services in 2023 (i.e., arts “subdomains”)

Crafts and film are by far the largest arts export products. As demonstrated in the following graph, the largest contributor to arts exports is crafts (within the visual and applied arts domain), with $7.3 billion in exports in 2023 (27% of all cultural exports). Imports of craft items were also strong, totalling $6.2 billion (17% of all cultural imports), resulting in a crafts trade surplus of $1.1 billion.

Film and video (within the audio-visual and interactive media domain) is another major contributor to exports and has the largest trade surplus among the areas of the arts captured in the dataset: exports of $5.6 billion (21% of all cultural exports), imports of $1.7 billion (5% of all cultural imports), surplus of $3.9 billion.

The data for live performances and sound recording were described above, because these areas of the arts are considered domains (not subdomains, as are the other items described for the first time here).

The other areas of the arts shown in the graph are:

Books: exports of $0.9 billion (3% of all cultural exports), imports of $3.1 billion (9% of all cultural imports), deficit of $2.1 billion (after rounding)

Original visual art: exports of $0.07 billion (0.2%), imports of $0.1 billion (0.3%), deficit of $0.04 billion (after rounding)

Photography: exports of $0.03 billion (0.1%), imports of $0.3 billion (0.8%), deficit of $0.3 billion

The books export estimate is probably low, because it excludes a similar export value ($0.9 billion) that is categorized as “multi-subdomain”, meaning that trade in those items could not be classified into a single subdomain within written and published works.

Interactive media (within the audio-visual and interactive media domain but not counted among the arts in this analysis) is also a major source of cultural exports: $2.4 billion (9% of all cultural exports), imports of $1.5 billion (4% of all cultural imports), surplus of $0.9 billion.

Data source

Statistics Canada also publishes data on interprovincial trade in cultural goods and services, but that dataset only covers up to 2021. Because it is so old, I haven’t included it here.

The international trade dataset is based on multiple sources, including surveys and administrative filings by cultural businesses, organizations, and individuals. As just one example, here is the main export-related question from the performing arts survey:

During the reporting period [of x to y], did this business receive revenue from clients outside Canada for the sale of products, services, royalties, rights, licensing or franchise fees?

If the respondent answered yes, they were asked follow-up questions regarding revenues from their exports and the percentage breakdowns of exports by country as well as into 1) goods; 2) services; and 3) royalties, rights, licensing and franchise fees.

The series of questions related to imports is identical to the above, except that the questions refer to “payments to suppliers outside Canada” rather than “revenue from clients outside Canada”.